What is Behavioral Finance and how does it differ from traditional finance?

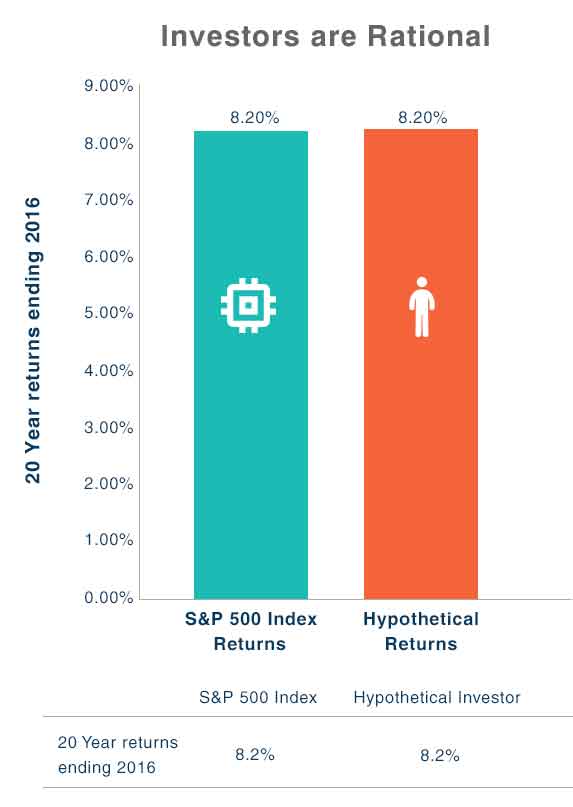

Traditional finance says Investors are rational human beings that can process information accurately, behave rationally and make unbiased decisions considering only facts and avoiding emotions. If that were the case, investor and index returns should have been the same? Traditional Finance explains how investors and markets should behave.

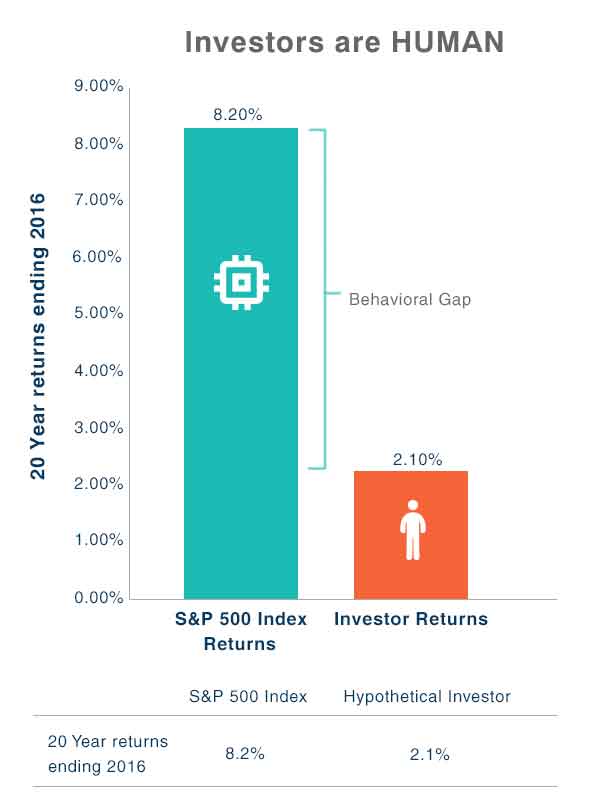

Dalbar study shows that over the same period, investors underperform the index by more than 600 bps or 6%! Why is that? Because we are HUMAN!

Behavioral Finance explains this ‘behavior gap’ in returns to be beyond fees. Investors earned only 2.1% as they were trying to time the market- buying high and selling low! Investors make irrational decisions using flawed assumptions and emotions. Investment decisions are driven by greed and or fear than underlying investment or market fundamentals. Behavioral Finance uses psychology and economics to explain investor behavior- why we behave the way we do!

Source: DALBAR, Inc. Average investors returns are based on an analysis by DALBAR Inc., which utilizes the net aggregate of mutual fund sales, redemptions and exchanges each month as a measure of investor behavior. Returns are annualized (and total return where applicable) and represent the 20-year period ending 12/31/15.

Source: Behavior Gap, Carl Richards, behaviorgap.com

At PIC, we “believe that human beings are unknowingly hamstrung by overconfidence, limited attention, cognitive biases and other psychological factors which inevitably cause errors in judgment. These factors affect everything from how we invest in stocks, to how we respond to marketing offers, to how we choose which sandwich to buy for lunch.”─Daniel Kahneman.

Source: knowledge.wharton.upenn.edu/article/

Why does it matter?

Using emotions to make decisions on investments can be a costly mistake.Investment professionals are also subject to emotions as they too are human! By being aware and understanding how we behave, it may be possible to modify behaviors to produce better economic outcomes. Here are some examples of how emotions can impact our decision making:

- Overconfidence:Overconfident investors and traders tend to believe they are better than everyone else in choosing the best stocks or the best mutual funds. Few easy lucky successes may make them believe that they are better and wiser in choosing investments. It’s ‘ I know what’s going to happen next…’ syndrome.

- Anchoring:Investors may anchor to a piece of information perhaps a purchase price while analyzing an investment decision. A strategist may stay invested in an asset class that is underperforming, in the hope they will get back on track or will get break even to the entry point. In 2008 financial crisis, many Value managers got caught in the ‘Value trap’ and held on and in many cases doubled down into AAA rated Lehman Bros. stock until that fateful Friday afternoon when Lehman went bankrupt and the value of their investment went to 0!

- Loss Aversion:Losing money is twice as painful. This behavioral predisposition is part of the original prospect theory in 1979. Investors remember losses forever and they don’t remember the years they made high returns. The fear of loss and career risk may make investment professionals conservative in their decision making.

What does PIC offer?

At PIC, we believe emotions can be managed through processes and systems that are repeatable, transparent and disciplined. PIC offers:

- Creation of processes and systems for asset allocation, due diligence of money managers, trading among others for your firm.

- Independent evaluation of your firm’s processes.

- Develop workshops and presentations supporting your firm as it manages end client’s emotions.

- Review client investment risk profiling process from the behavioral lens.

Are you running mile a minute managing your client relationships, financial planning and managing investment strategy?

Are you looking to reduce costs and focus on client relationships?

Are you looking for flexibility while keeping investment discretion?

Are you looking to expand your investment department to include CFAs without incurring the cost of a full-time staff?

You have heard about behavioral investing and are not sure about how it can benefit your firm?

Are you looking to build due diligence processes for your third-party managers?

Are you looking for timely investment insights, blogs and newsletters customized for your firm’s clients?

Do you need an independent evaluation of your prospect’s investments?

Do you need an unbiased opinion on your current investment strategies?

Are you looking for professional investment support in pitching for new business?

You have a unique investment area not covered above and you are looking for a professional opinion.

Are you staying awake worrying about new regulations and how your firm’s processes abide by them? What you like an independent evaluation?