Dow Average Sinks More Than 1,100 Points, Most Since 2011!

S&P 500 Plunges 4.1% in Steepest Decline Since August 2011!

$1Trillion Market Cap Erased!

Reasons to panic? I have to admit it feels like the natural thing to do when losses continue to mount and such headlines bombard us.

10 steps to Calming Down as you process the market news that surrounds you:

1. Acknowledge your fears: A volatile market is scary. Ignoring or denying your fear will only exacerbate the problem. As Scott Peck said, “The absence of fear is not courage. The absence of fear is some kind of brain damage. Courage is the capacity to go ahead in spite of fear.” It is normal to have some anxiety during a market correction.

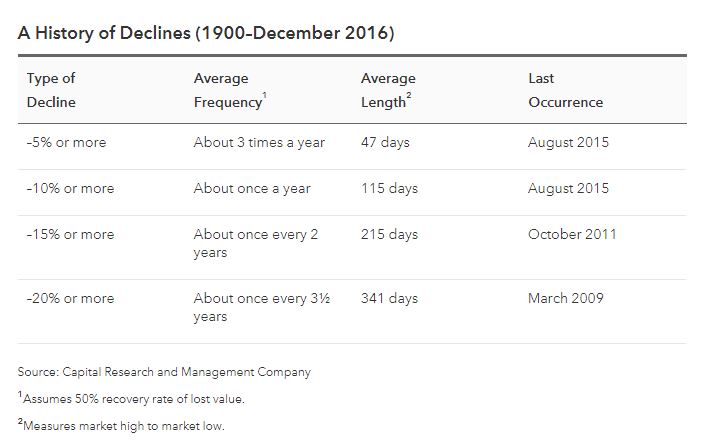

2. Understand That Market Corrections are Normal: Remind yourself that market corrections are not unusual, but part of a normal, inevitable market cycle. Here is a quick table below:

Source: https://www.americanfunds.com/individual/planning/market-fluctuations/past-market-declines.html

3. Recognize That We Have Been Through Worse. Since 1928, we have survived through many challenging events that defined their generation: the Great Depression, World War II, the Cold War, the Vietnam War, the high inflation of the 1970’s, the forced resignation of a President, the terrorist attacks of September 11, and the Financial Crisis of 2008-2009 just to name a few. The S&P 500 has gained +10.1% per year (total return) over the last 50 years (1968-2017) despite suffering through 7 bear markets of at least a 20% decline each time (source: BTN Research).

4. Remember We Are Investors, Not Speculators. Market speculators make huge, short-term bets on the movement of the market. They can make or lose huge sums of money due to short-term volatility. The recent losses endured by Bitcoin investors are a prime example of how short-term market bets can result in enormous losses. We are long-term investors, not speculators. As a result, the short-term movement of the market, though unsettling, has a little practical impact on our lives.

5. Bet on the Power of Capitalism. We believe capitalism has been the greatest force for wealth creation in the history of man. By maintaining your long-term investment in the stock market, you are betting on the power of capitalism to overcome adversity. If you run for cover and sell your holdings, you are betting against capitalism. Which makes more sense to you?

6. Ignore the “Crisis of the Day” Mentality. The media are always talking about the crisis of the day. Today’s crisis quickly becomes tomorrow’s distant memory only to be replaced by the next pending disaster. The media are driven by ratings and the truth is that fear sells. Have you noticed how often the media use the caption “Breaking News” to headline almost any story these days? Try not to pay too much attention to today’s crisis, and remember the media’s goal is to scare you so you will tune in tomorrow and improve their ratings.

7. Make Confidence-Based Decisions. During our lives, we all make some decisions based on confidence and some based on fear. Our experience is that our confidence-based decisions serve us much better. If you overreact to a short-term market correction, you are making a fear-based decision, and that decision could materially impair your ability to achieve your long-term goals.

8. Remind Yourself That a Bear Market is When Stocks Return to Their Rightful Owner. Legendary financier Bernard Baruch is often credited with having said, “In a bear market, money returns to its rightful owner.” That saying is just as true today as it was 200 years ago. The reason stocks have historically returned more than bonds over the long term is because stockholders endure the volatility of the market. Without the volatility that goes hand-in-hand with stock ownership, the risk returns associated with stocks would diminish, and so would the attendant wealth.

9. Focus on What Really Matters in Life. It is easy during stressful times to forget about what really matters in life. When you are feeling anxious, try to divert your focus from the market and think about what matters most to you in life. If those areas of your life are going well, does it really matter if the market is undergoing one of its regular and temporary market corrections?

10. Have Faith in Diversified Portfolios. Although the future is never guaranteed, a diversified portfolio approach to asset management is based on investment fundamentals that have withstood the test of time. If you are feeling particularly nervous, talk to Practical Investment Consulting. If we are not panicking, chances are you should not panic either.

Disclosures and Disclaimers:

The information provided herein is for general educational and entertainment purposes only, and should not be considered an individualized recommendation or personalized investment or financial advice; nor should the information provided herein be considered legal, tax, accounting, counseling or therapeutic advice of any kind. Any examples or characters mentioned herein are hypothetical in nature, purely fictitious, and do not reflect any actual persons living or dead. Practical Investment Consulting makes no representations, whether express or implied, as to any expected outcome based on any of the information presented herein. Users assume all responsibilities or the use of these materials, including the responsibility of protecting the privacy of their responses. Practical Investment Consulting does not accept any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this document or its contents.

This material is intended for the personal use of the intended recipient(s) only and may not be disseminated or reproduced without the express written permission of Practical Investment Consulting. The information contained in this email message is being transmitted to and is intended for the use of only the individual(s) to whom it is addressed. If the reader of this message is not the intended recipient, you are hereby advised that any dissemination, distribution or copying of this message is strictly prohibited. If you have received this message in error, please immediately delete.