“I knew and you should have known…””

“That the Seahawks were going to lose.””

“That the S&P 500 was going to rally double digits in 2014.””

“Surely, someone knew this was going to happen and profited from it.””

We probably all have heard similar statements. It makes us wonder if anyone is aware of the havoc hindsight bias can play on an investor’s portfolio.

What is hindsight bias?

Wikipedia describes it as the “I-knew-it-all-along” effect. Psychologically speaking, it is the inclination, after an event has occurred, to see the event as having been predictable – despite the fact that there was little or no objective basis for predicting the outcome. It’s a common memory distortion that can lead us to find casual connections where none exist and these errors can affect how we interpret not only a past event but future events as well.

Hindsight bias can lead investors to buy high and sell low.

The danger of hindsight bias isn’t just that it affects one bad call. The real danger is that believing somebody “should have known” can lead investors to make decisions and design portfolios with too little consideration for their own risk or goals. How? Overestimating the accuracy of our past forecasts may lead to overconfidence in our future forecasts (“Hey, I was right before!”) and hence to taking excessive risks.

Hindsight bias also can affect relationships between investors and their advisors; if an investor believes his or her advisor should have been able to accurately forecast market performance, they could lose confidence in their advisor’s abilities and advice.

Hindsight bias can affect everyone.

After the fact, events often seem “obvious” and “inevitable.” Most people forget what they were thinking before the event occurred.

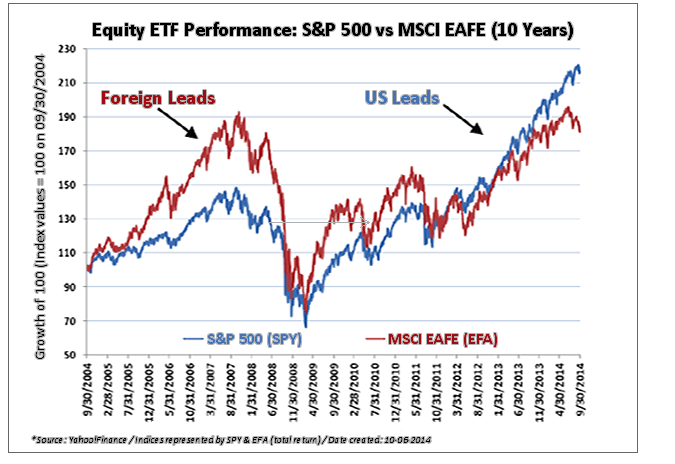

For example, a globally diversified portfolio, one that contains both international and U.S. investments, looks silly (or worse) since the U.S. market has outperformed the international markets by 100% over the past six years.

When we feel the first “But this was so obvious!” thoughts creeping in, this is when we should pause and think about not only what did happen but what could have happened.

Still not convinced?

Let’s take a broader look at how U.S. markets performed in comparison to international markets.

If you remember, in the 1990’s, the U.S. outperformed international markets essentially throughout the entire decade. By the time the dot.com market became the dot.com bubble, most Americans considered it foolish to invest in overseas companies.

Do you remember what happened next?

The chart shows International markets regained the lead over domestic markets around the bottom of the bear market; beginning in 2002, and they outperformed U.S. markets for six consecutive years – until the subprime crisis (likewise unpredicted) hit in 2008.

Do you now feel more or less confident about predicting which one will lead this year? Hindsight bias can make any tactic employed to defend against potential bear market scenarios in the past look silly when viewed from the perspective of the current U.S. market leader.

Source: Morningstar

The future is not as predictable as we might like to believe.

Who predicted that oil would fall 50% from its recent highs? Or that the Swiss Franc would rise 41% in a single day? When you start to think you could have or should have predicted it, remember, everyone else thinks they can, too. Someone is always wrong, and most of us can’t remember times when we were wrong because it’s part of the memory distortion that comes with hindsight bias.

Invest for an unpredictable future.

We recommend making investment decisions based on what you need an investment to do for you, not based on what you think is going to happen.

Acknowledging what we cannot control helps us stay focused on what we can control.

Life does not always play out according to even our best-laid plans.

Expect the unexpected.

Ask yourself what could go wrong and manage for that possibility, rather than focusing exclusively on what you believe will go right.

Remember the importance of diversification. It’s not to increase portfolio returns; rather, diversification is designed to protect you should events not turn out exactly as you would like.

THANK YOU JOYN. ARTICLE PREVIOUSLY POSTED HERE:

https://joynadvisors.com/hindsight-bias-in-investing/

Disclosures and Disclaimers:

The information provided herein is for general educational and entertainment purposes only, and should not be considered an individualized recommendation or personalized investment or financial advice; nor should the information provided herein be considered legal, tax, accounting, counseling or therapeutic advice of any kind. Any examples or characters mentioned herein are hypothetical in nature, purely fictitious, and do not reflect any actual persons living or dead. Practical Investment Consulting makes no representations, whether express or implied, as to any expected outcome based on any of the information presented herein. Users assume all responsibilities or the use of these materials, including the responsibility of protecting the privacy of their responses. Practical Investment Consulting does not accept any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this document or its contents.

This material is intended for the personal use of the intended recipient(s) only and may not be disseminated or reproduced without the express written permission of Practical Investment Consulting.