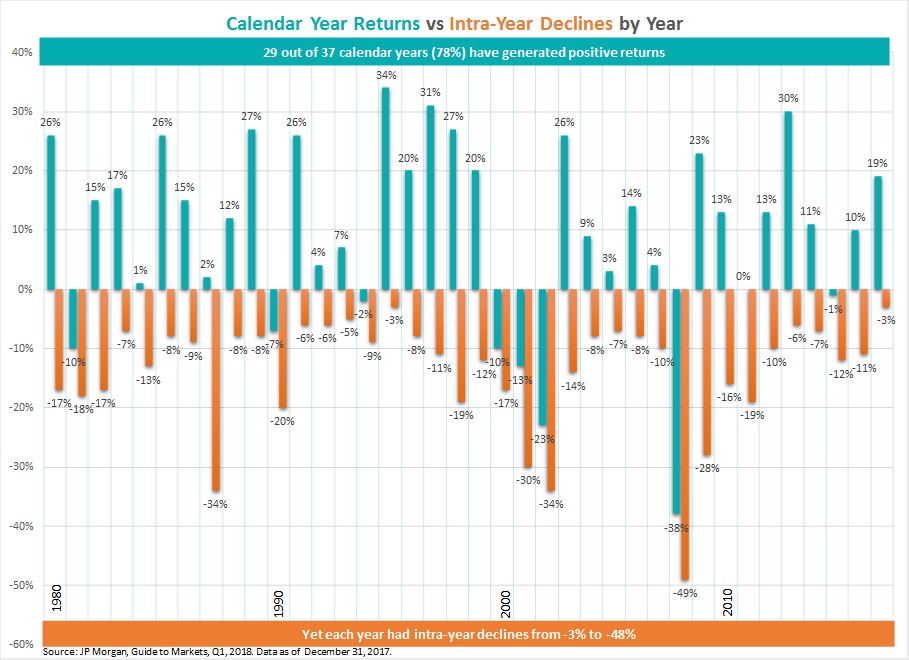

As the US markets soar into another year of its extended bull market run, talks of correction, cautiousness and risk mitigation become more mainstream than ever. At such times of fear for a market correction, I like to focus on this chart.

It shows almost 4 decades of data, and 78% of the time, S&P 500 has delivered a positive return. 29 out of 37 calendar years have generated positive returns, yet each year has seen intra-year declines ranging from -3% to -48%. It’s a great visual to show clients that are amassing cash in fear of the inevitable correction. Corrections and losses are temporary- the opportunity cost of sitting out of the market is permanent.